Cryptocurrency adoption is no longer a fringe trend. More than 52 million Americans now own digital assets, and usage continues to rise—particularly among younger, digitally native consumers. Yet while adoption has accelerated, the infrastructure supporting it has not kept pace with the regulatory rigor, customer protections, and operational discipline expected in financial services.

One of the clearest examples is the rapid expansion of crypto ATMs. More than 30,000 machines operate across the U.S., representing nearly 90% of the global market. Most are run by independent operators, often outside of meaningful regulatory oversight. High transaction fees, limited transparency, and weak compliance controls have eroded trust—creating both risk for consumers and an untapped opportunity for banks.

For community banks, this gap represents more than a trend to monitor. It’s an opportunity to professionalize an emerging channel, attract new customers, and generate sustainable fee and deposit growth—without compromising regulatory standards.

The Market Reality: Growth Without Guardrails

Crypto ATMs have scaled quickly, but the dominant operating model has clear shortcomings:

- Excessive fees, often ranging from 8% to 20% per transaction

- Minimal compliance oversight, increasing fraud and AML risk

- Cash-only settlement, with no integration into deposit accounts

- Low consumer trust, driven by inconsistent standards and limited recourse

Despite these issues, demand continues to grow. One in five U.S. adults under 40 owns cryptocurrency, and the global crypto ATM market is projected to exceed $10 billion by 2030. Consumers want access—but they also want safety, fairness, and transparency.

How Community Banks Can Redefine the Crypto ATM Model

Community banks are uniquely positioned to bring structure, compliance, and credibility to a fragmented market. A bank-led crypto ATM model looks fundamentally different from today’s independent operator approach:

- Fair, transparent pricing, typically in the 3%–6% range

- Direct integration with deposit accounts, not cash-only transactions

- Robust BSA/AML controls, aligned with regulatory expectations

- Stablecoin support, such as USDC, to reduce volatility risk

Instead of forcing customers to move between disconnected systems, banks can create a seamless bridge between digital assets and traditional banking. For example, a customer converts stablecoin holdings at a bank-operated ATM and sees the proceeds deposited directly into their checking account—clearly priced, fully compliant, and trusted.

This approach doesn’t just mitigate risk. It builds confidence, attracts younger customers, and reinforces the bank’s role as a safe on-ramp to financial innovation.

The Economics: Fee Income and Deposit Growth

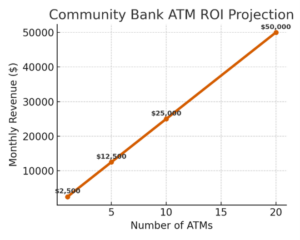

The financial case is compelling. Consider a single regulated crypto ATM processing $50,000 in monthly volume at a 5% fee. That machine generates approximately $2,500 per month—or $30,000 annually.

Scale that across 20 ATMs, and annual fee income exceeds $600,000.

NEW DEPOSIT REVENUE

![]()

The deposit opportunity is equally meaningful. If just 25% of ATM users open accounts, banks could see $12.5 million in new deposits, strengthening both revenue and balance sheet performance. Few initiatives offer this combination of recurring income, customer acquisition, and deposit growth with such a clear line of sight to ROI.

A Phased, Risk-Aware Path to Adoption

Entering the digital asset space doesn’t require a leap of faith. A structured, phased approach allows banks to innovate while maintaining control:

0-6 MONTHS

Phase 1

Launch a limited in-branch pilot with strong compliance controls and operational oversight.

6-18 MONTHS

Phase 2

Expand to select retail locations and introduce customer education to reinforce responsible usage.

18-24 MONTHS

Phase 3

Integrate with digital channels and enable stablecoin functionality for smoother settlement.

24+ MONTHS

Phase 4

Embed crypto services into the broader product portfolio as part of a mature digital asset strategy.

This progression balances innovation with governance—allowing banks to learn, adapt, and scale responsibly.

Managing the Risks Without Sitting on the Sidelines

Crypto-related initiatives will continue to attract regulatory scrutiny, reputational considerations, and volatility concerns. But these risks are manageable when approached deliberately:

- Regulatory alignment with OCC, FDIC, and FinCEN expectations

- Clear positioning of crypto ATMs as compliant financial services—not speculative tools

- Volatility mitigation through stablecoins and controlled settlement options

Avoiding the space entirely doesn’t eliminate risk—it simply leaves customers to navigate it elsewhere.

THE BOTTOM LINE

Crypto ATMs are here to stay.

The question is who will define their future.

Independent operators have proven demand, but their model cannot scale sustainably. Community banks have the opportunity to step in with what the market is missing: trust, compliance, and customer-first design.

By doing so, banks can unlock new revenue streams, grow deposits, attract the next generation of customers, and position themselves as credible leaders in an evolving financial ecosystem—bridging Main Street banking with the digital asset economy.

About the Author

John M. Zazzera is an accomplished banking and fintech executive with extensive leadership experience across top financial institutions. He has served as President of GE Capital’s Mid-Atlantic Region and as Senior Vice President at JPMorgan Chase, where he specialized in risk-based pricing strategies. His career also includes senior leadership roles with TD Bank, FIS, Wells Fargo, and RBS, where he drove innovation and operational excellence across multiple lines of business. In addition, he has held executive leadership positions as Chief Operating Officer at FundBank and Chief Executive Officer of First National Bank of Pasco, bringing a unique combination of strategic vision, regulatory expertise, and hands-on operational leadership to every role.